Changing Course

Share this blog

Latest Maritime Vacancies

Dry Cargo Shipbroker

Laytime Specialist – Hamburg/Lübeck

Head of Dubai – Dubai

Dry Cargo Shipbroker – Piraeus, Greece

Dry Bulk Broker

China’s sea trade grows despite economic setbacks

by Richard Scott FICS

Committee Member, London & South East Branch, Institute of Chartered Shipbrokers

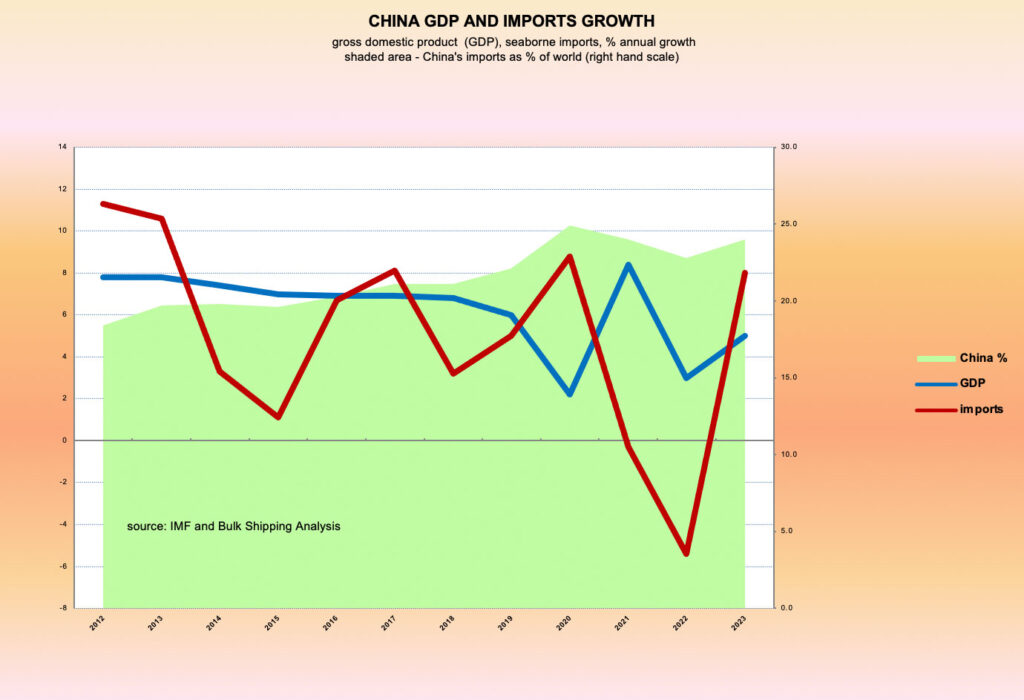

For many professionals involved in global maritime shipping activities, a relevant topic is the progress of China’s seaborne trade, comprising a large proportion of the world’s total. This year China’s economy has seen setbacks and only narrowly avoided ‘crisis mode’, while seaborne imports have surged, benefiting the bulk carrier, tanker, and gas carrier markets.

The upsurge in imports into China during the first nine months of 2023 has been an especially significant influence in shipping markets. These imports – dry bulk commodities, oil, gas and manufactured goods – are transported on a vast scale, totalling around 3 billion tonnes annually and comprising almost a quarter of the entire world sea trade volume.

China is by far the biggest importer of seaborne cargoes. Its prominence as an exporter is on a smaller scale although, in manufactured goods, container shipments are extensive, forming a high percentage of global trade in that category.

A struggling economy

When the Chinese government decided at the end of last year to abruptly halt pandemic controls embodied in their strict zero-covid policy, many observers expected that the easing of restraints on economic activity would see a strong and sustained rebound through 2023. In the first quarter the expectation seemed to be proving correct. During this period gross domestic product grew at an annualised rate of about 9% from the previous quarter. Since then economic growth has faltered, although the latest data is more positive.

In the 2023 second quarter weakness emerged and GDP growth slowed to about 2% annualised. Despite government measures designed to reinvigorate economic activity’s recovery, progress was limited and signs suggested that the slack trend might become entrenched. A crisis or, at least, a crunch point seemed to be approaching. The deepening downturn in the property sector, comprising about a quarter of the economy, was notable while consumer spending remained subdued.

Recent indications have been somewhat brighter. Initial estimates of GDP in the July-September quarter show growth exceeding 5% annualised, an improvement and slightly better than expectations. But consumer confidence remains fragile and it is now estimated that property investment in the first nine months of 2023 fell by almost a tenth from last year’s same period. Nevertheless, economists suggest the stabilising signs imply that the government’s 5% growth target for 2023 as a whole could be achieved (following last year’s covid-depressed 3% GDP growth rate).

Brisk imports performance

Amid the economy’s faltering progress, a remarkable upturn in commodity imports has been occurring. Looking at four commodities together comprising over two-thirds of all China’s seaborne cargo imports, big increases were seen in the January-September period of 2023, compared with the same period of last year. Iron ore – the largest individual import trade – was up by 7% to 877 million tonnes, crude oil was up by 15% at 424mt, coal was 51% higher at 348mt, and soyabeans increased by 14% to 78mt.

What caused this expansion? Strong import demand growth may seem surprising when China’s economy has been performing poorly compared with preceding years when vigorous imports enlargement was evident. More specific influences in individual trades have provided a boost in 2023.

In the coal imports segment the huge 118mt increase seen in the first 9 months of this year, substantially benefiting bulk carrier employment, reflected several changes. Extra demand for energy as the economy regained momentum, coupled with reduced hydro-electric power supplies, boosted coal use. Meanwhile, growth in production of coal from China’s domestic mines was insufficient. Greater reliance on imports is partly exaggerated by comparison with unusually low volumes at the beginning of last year.

Higher imports into China are likely to contribute most of the global increase in crude oil trade envisaged for 2023. Growth is attributed to rising energy demand accentuated by expanding aviation fuel use, while Chinese importers have taken advantage of attractive oil prices to build stocks and improve energy security. Another reason ls refineries’ increased exports of oil products.

But there is uncertainty about whether and to what extent these positive patterns will continue into 2024. Even after assuming that China’s economy avoids further setbacks and continues its recovery advance, some import categories are unlikely to maintain the current year’s expansion rates. Several temporary influences that boosted import inflows in recent months may not persist much longer.

Follow Richard on LinkedIn – https://www.linkedin.com/in/richard-scott-98513134/