Changing Course

Share this blog

Latest Maritime Vacancies

Client Executive

Technical Superintendent (Dry) – Europe

Tanker Technical Superintendent – Europe

HSSEQ Superintendent – Europe

Fleet Manager (Dry) – Europe

What do VLCCs do with their time?

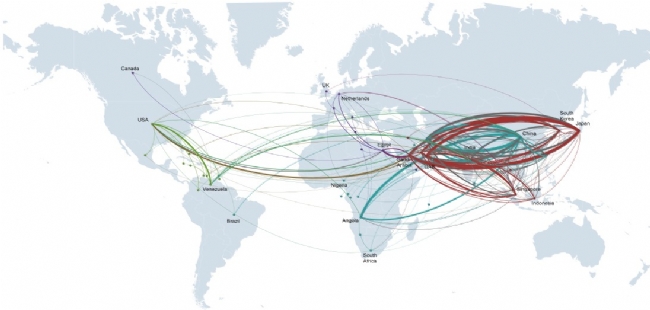

Our friends at ship valuation company Vessels Value have been investigating operating performance, looking at what VLCCs do with their spare time. To create this, an annual snapshot of global VLCC traffic is analysed. Various patterns emerged from the AIS data which highlights the importance of the energy hungry Eastern economics. The growing prominence of Angola's exports to China, along with the reduction in the Crude imports by the US, is most notable from the graph on the right (click to enlarge the photo). The reliance of South Korea and Japan on the Middle East for energy security is highlighted, whereas China has a more diversified approach towards sourcing their crude oil requirements.

There is also an interesting pattern when taking Saudi crude to USA. In order to minimise the ballast leg, tankers are travelling to Venezuela to pick up crude, before returning to Indian refineries. From there, it is a short leg back to Saudi Arabia to begin the process again.

The image (right) comes from Vessel Value's new VVQ Bespoke Consultancy. By bringing together a team of PhD students, professors, mechanical engineers, mathematicians and ship brokers, they have brought the same instant access of entire ship databases to unique and personalised reports.

Fourteen new reports have already been designed, built and put in place with a variety of different clients spanning the entire maritime industry. New products include Ton Mile Demand, Conditional Volatility, Income Valuation, Fleet at Risk valuations and LSFO Bunker Forecasting. By delivering these reports on a time frame to suit the client, anywhere from weekly to once a year, this new approach to shipping is driving the entire maritime industry into the 21st century.

Find out more at www.vesselsvalue.com.