Changing Course

Share this blog

Latest Maritime Vacancies

Business Development – Shipmanagement – Dubai

Office Manager – London

Shipping Paralegal – London

Shipping Manager – Singapore

Office Administrator – London

Freight trading bonuses down

The freight derivatives market began in the early 1990s, but it wasn’t until the early 2000s, when the commodities boom brought a steady climb in freight rates, that freight trading really increased in popularity as shipowners and charterers looked to protect themselves against fluctuating transport costs in a volatile market.

As the freight derivatives market matured and freight began to be seen as a commodity in its own right, commercial shipping began to split into two tiers. On one hand: traditional chartering staff, responsible for chartering vessels to carry in-house cargoes or for chartering out owned tonnage and on the other hand freight traders, who operate third party tonnage to carry third party cargoes, possibly also hedging exposure to freight market risks.

Freight traders sit at the higher-risk end of the chartering market and can be found at shipowners and charterers who are also operators, in pure operating companies and in banks and commodity / oil / mining groups.

Given the higher levels of risk to which they are exposed and the potential profits (as well as losses) they can make for their companies, it is perhaps not surprising that salaries, and particularly bonuses, paid to freight traders have always outstripped those of traditional charterers.

In a strong market, freight trading ‘superstars’ have the potential to earn on a whole other level from traditional charterers. Certainly, in recent years, 100%+ and even 200% bonuses were not uncommon in the freight trading world. A bonus of only 50% of salary might have been considered a poor year!

But times have changed and as the short-term outlook continues to look bleak for the dry bulk market in particular, we look at what effect has this had on the golden boys and girls of commercial shipping.

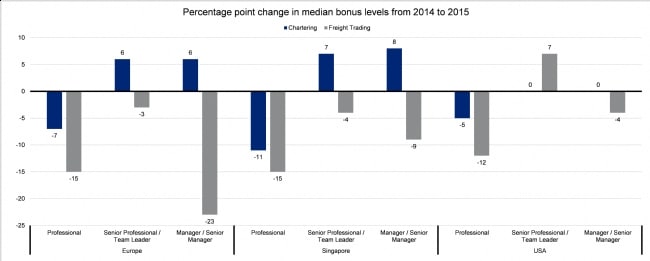

The bar chart (pictured top right, click to expand) shows mid-market freight trading bonus levels falling across the board in 2015, shown by the grey bars. The smallest drop was experienced by senior freight traders / freight trading team leaders.

On the whole, senior charterers, team leaders and chartering managers saw their bonus levels increase in 2015. It was just the unfortunate professional-level charterers (those with around two to five years’ experience) whose bonus levels fell last year.

It would appear that the unlucky lower levels have been hardest hit when it comes to bonuses, followed by the freight trading managers – perhaps sacrificing their own bonuses to keep hold of their prized and skilled senior freight traders?

Three times as many freight traders – 21% – received no bonus at all last year, compared with only 7% in the previous year. In 2014, 30% of charterers received no bonus and this percentage increased slightly to 34% last year.

The number of ‘big’ bonuses also fell significantly in 2015 for freight traders. Bonuses of more than 100% of salary fell by a third in 2015. In particular, those employed by commodity groups, no doubt impacted by the commodities slump, were worst affected.

It is worth noting though, that despite the universal drop in freight trading bonuses in 2015, the dollar value of freight trader bonuses was higher than traditional chartering bonuses at each level and in each location.

Base salary levels for both charterers and freight traders remained fairly consistent in 2015, although we did see a noticeable increase in salaries for professional-level freight traders. At this level, salaries were around 10% higher in Europe, 13% higher in the US and a whopping 38% higher in Singapore, compared with 2014 (see chart, pictured right).

As we saw above, bonus levels were down significantly last year for this group of individuals. It looks like some companies are guaranteeing income for their junior freight traders in an effort to hold onto them at a time when the chance of a decent bonus is looking increasingly slim.

Amanda James, Compensation & Benefits Consultant, HR Consulting. You can find out more at www.hrc.spinnaker-global.com